If you’re experiencing this problem with this brand or any other company, submit your complaint and we may feature it on Choice4Voice.com.

Submit your complaint →Update:

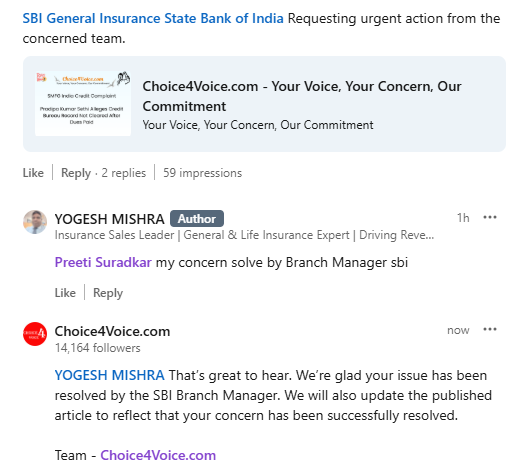

This case has been resolved as confirmed by the complainant, Mr. Yogesh Mishra. The issue was addressed by the SBI Branch Manager. A screenshot confirmation has also been attached for reference.

Yogesh Mishra, an Insurance Sales Leader, raised a serious complaint against SBI General Insurance and State Bank of India’s Sultanpur City Branch (Code: 11216). He was misled into purchasing a Group Term Insurance policy worth ₹2000 under false assurances. The complaint highlights mis-selling, unethical practices, and violation of customer trust. Yogesh demands cancellation of the policy, refund of money, and strict action against the official. This case raises concerns about transparency in SBI General Insurance and the responsibility of India’s largest bank towards customer rights.

Complaint Summary : Complaint Against SBI General Insurance and SBI Sultanpur Branch by Yogesh Mishra – Mis-Selling of Group Term Insurance

| Detail | Information |

|---|---|

| Complainant Name | Yogesh Mishra |

| Profession | Insurance Sales Leader, MBA in Marketing & Finance |

| Company/Brand Involved | SBI General Insurance / State Bank of India |

| Branch Name | Sultanpur City Branch |

| Branch Code | 11216 |

| Policy Type | Group Term Insurance |

| Proposal Number | 119713452 |

| Amount Involved | ₹2000 |

| Issue Type | Mis-Selling / Misrepresentation |

| Relief Sought | Policy cancellation, full refund, disciplinary action against staff |

| Escalation Threatened | Complaint to Banking Ombudsman, IRDAI, and regulatory bodies |

| Complaint Source | Public LinkedIn Post by Yogesh Mishra |

Full Complaint Write-Up

Yogesh Mishra, an experienced Insurance Sales Leader and industry professional, has raised a strong complaint against SBI General Insurance and State Bank of India Sultanpur City Branch (Code: 11216).

According to him, an official from the branch misled him into purchasing a Group Term Insurance policy (Proposal No. 119713452) worth ₹2000. He was falsely assured that without this policy, his bank account would not remain active.

This is a classic case of mis-selling and misrepresentation, which goes against fair banking practices and consumer trust. Such unethical practices not only create financial burden on customers but also tarnish the reputation of a prestigious institution like SBI.

Yogesh Mishra has demanded:

- Immediate cancellation of the policy.

- Refund of ₹2000 without delay.

- Strict disciplinary action against the official responsible for mis-selling.

He has further warned that if SBI fails to resolve the issue promptly, he will escalate the matter to the Banking Ombudsman, IRDAI, and other regulatory authorities.

This complaint highlights the growing concerns of mis-selling in the Indian banking and insurance sector, especially when customers are misinformed about the mandatory nature of certain products.

About the Brand

State Bank of India (SBI) is India’s largest public sector bank with millions of customers across the country. Its subsidiary, SBI General Insurance, offers multiple insurance products including health, motor, travel, and term policies. While the brand is considered reputable, incidents of mis-selling at branch level have been frequently reported by customers.

Such cases indicate a gap between corporate policies and on-ground practices by bank officials. To maintain trust, SBI must ensure stricter monitoring and training to prevent such unethical practices.

Which Legal Actions Can Be Taken?

In cases of mis-selling by banks or insurance companies, the complainant has the right to take the following legal actions:

- File a complaint with the Banking Ombudsman under the RBI guidelines.

- Approach the Insurance Regulatory and Development Authority of India (IRDAI) regarding mis-selling of insurance policies.

- File a consumer complaint in the Consumer Forum under the Consumer Protection Act for misrepresentation and unfair trade practice.

- Seek compensation for financial loss and mental harassment caused by the mis-selling.

Next Steps with Choice4Voice.com

Posting a complaint on Choice4Voice.com is the first step to make the issue public and highlight unethical practices by big brands like SBI. If the complaint is not resolved, Choice4Voice.com can initiate legal action against SBI General Insurance and SBI Sultanpur Branch on behalf of the complainant, ensuring justice and accountability.

About the Author

This complaint has been raised by Yogesh Mishra, an Insurance Sales Leader, MBA in Marketing & Finance, and expert in General & Life Insurance Sales. With years of experience in the insurance sector, he is well aware of fair practices and customer rights.

This article has been written based on his original LinkedIn post where he publicly highlighted this grievance.

👉 Link to Original LinkedIn Post

Q&A Section

Q1: What is mis-selling in banking and insurance?

Mis-selling occurs when a financial product is sold to a customer by providing false or misleading information, making the customer believe it is mandatory or beneficial when it is not.

Q2: What is the complaint of Yogesh Mishra against SBI General Insurance?

He was misled into purchasing a Group Term Insurance policy worth ₹2000 under the false assurance that his account would not remain active without it.

Q3: Can SBI force customers to buy insurance with a bank account?

No, SBI or any other bank cannot force customers to buy insurance for keeping their account active. This is an illegal and unethical practice.

Q4: What is the proposal number mentioned in this case?

The proposal number is 119713452 for the Group Term Insurance policy.

Q5: What action has Yogesh Mishra demanded from SBI?

He has demanded cancellation of the policy, refund of ₹2000, and strict action against the official.

Q6: Can customers file a complaint against SBI General Insurance for mis-selling?

Yes, customers can approach the IRDAI, Banking Ombudsman, and Consumer Forum for redressal.

Q7: How can mis-selling affect customers?

It leads to financial loss, mental stress, and a breach of trust between the customer and the institution.

Q8: What is the branch code of the SBI Sultanpur City branch involved in this case?

The branch code is 11216.

Q9: Is Group Term Insurance mandatory for SBI account holders?

No, it is not mandatory. Any claim by a bank official making it compulsory is false.

Q10: How can customers protect themselves from mis-selling?

Customers should always verify product details, ask for written terms, and avoid signing under pressure.

Q11: Can a bank deduct money without consent for insurance?

No, money cannot be deducted without clear consent from the customer.

Q12: What legal recourse does a customer have against mis-selling by banks?

The customer can approach the Banking Ombudsman, IRDAI, or Consumer Forum.

Q13: What role does IRDAI play in such cases?

IRDAI regulates insurance companies and ensures that mis-selling complaints are investigated and resolved.

Q14: Can Choice4Voice.com help in filing a case against SBI?

Yes, Choice4Voice.com can support in escalating the case legally if the bank does not resolve the issue.

Q15: What documents are required to file a mis-selling complaint?

Customers should keep the policy proposal number, receipts, branch details, and communication records.

Q16: Is mis-selling common in Indian banks?

Yes, mis-selling is a common issue where customers are pressured into buying unwanted insurance or financial products.

Q17: Can the Banking Ombudsman penalize SBI for mis-selling?

Yes, the Ombudsman can pass directions for refunds, cancellation, and disciplinary action.

Q18: What refund is Yogesh Mishra seeking?

He is seeking a refund of ₹2000 deducted for the policy.

Q19: How long does it take for IRDAI to resolve complaints?

It may take 30-60 days, depending on the complexity of the complaint.

Q20: Why is this case important for Indian consumers?

It highlights the unethical practice of mis-selling by trusted institutions and raises awareness for consumers to be cautious.