If you’re experiencing this problem with this brand or any other company, submit your complaint and we may feature it on Choice4Voice.com.

Submit your complaint →Bhavesh Tiwari exposes Axis Bank’s unethical practices over blocked Flipkart Axis Bank Credit Card. Despite non-usage, the bank demanded annual charges. Read full complaint on Choice4Voice.com

Note: If this issue is resolved, the concerned brand or the complainant may contact us at support@choice4voice.com. After proper verification, we will either update this article as “Resolved” or delete it, ensuring fairness to both parties.

Complaint Summary : Axis Bank Fraud-Like Practices Exposed – Customer Bhavesh Tiwari’s Complaint

| Detail | Information |

|---|---|

| Customer Name | Bhavesh Tiwari |

| Email ID | Not Disclosed |

| Complaint Type | Unethical Charges / Poor Customer Service |

| Company/Brand | Axis Bank |

| Branch Involved | Naroda Branch, Ahmedabad |

| Product/Service | Flipkart Axis Bank Credit Card |

| Year of Issue | 2022 |

| Key Issue | Card blocked, still charged annual fees |

| Branch Experience | Staff ignored, 3-hour wait, no manager support |

| Action Taken by Customer | Refused to pay, filing complaint in Consumer Court |

| Original Post Source | LinkedIn (Bhavesh Tiwari’s post) |

Full Complaint Write-Up

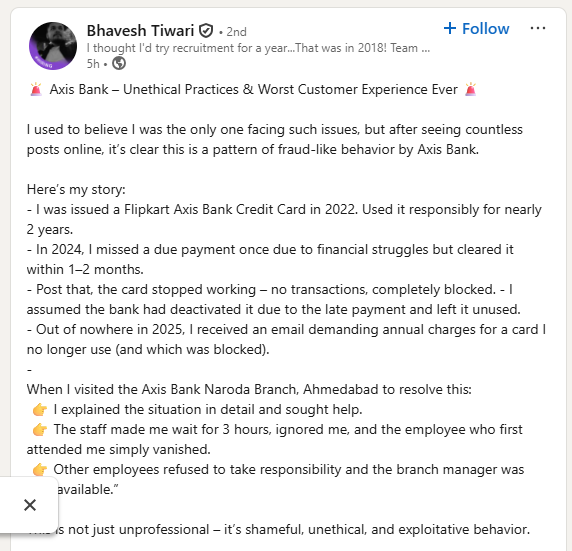

Axis Bank, one of India’s largest private banks, is once again under the spotlight for its unethical credit card practices. Customer Bhavesh Tiwari shared his ordeal on LinkedIn, revealing how Axis Bank harassed him with unjustified annual charges for a blocked card.

Bhavesh was issued a Flipkart Axis Bank Credit Card in 2022 and used it responsibly for almost two years. In 2024, due to financial hardship, he delayed one payment but cleared all dues within 1–2 months. Despite this, his card stopped functioning it was completely blocked.

Assuming the card was deactivated, Bhavesh left it unused. However, in 2025, Axis Bank shocked him by demanding annual charges for a card that was inactive and blocked.

When he approached the Axis Bank Naroda Branch in Ahmedabad, the situation worsened:

- He was made to wait for 3 hours.

- The staff member who first attended him vanished without resolving the issue.

- Other employees refused to take responsibility.

- The branch manager was “not available.”

Frustrated by the unprofessional and exploitative behavior, Bhavesh refused to pay the so-called dues and has now decided to file a formal complaint in Consumer Court.

His story is not isolated—several customers across India have raised similar complaints about Axis Bank’s unfair credit card billing, hidden charges, and poor customer service.

This case reflects a systematic pattern of harassment, where banks continue charging inactive cardholders while failing to provide transparency and accountability.

Key Concerns Raised

- Why is Axis Bank demanding annual charges for a blocked/inactive card?

- Why was the customer subjected to deliberate harassment at the branch?

- Why does Axis Bank lack a proper grievance redressal mechanism for credit card disputes?

Commonly Asked Questions (Q&A)

Q1. Can a bank charge annual fees on a blocked credit card?

No, if a card has been permanently blocked or deactivated, annual maintenance charges should not be applicable. Customers can challenge such charges in writing.

Q2. What should I do if Axis Bank charges me for an inactive credit card?

Immediately send a written complaint to the bank and escalate to the Banking Ombudsman or Consumer Court if unresolved.

Q3. Is it legal for Axis Bank to block a credit card after one delayed payment?

Banks have the right to block cards in case of payment defaults, but they must notify the customer and clarify whether the card is permanently cancelled.

Q4. Can I refuse to pay Axis Bank’s unfair charges?

Yes, if charges are unjustified, customers can refuse payment and file a formal dispute with evidence.

Q5. How can I escalate a complaint against Axis Bank?

- Contact Axis Bank’s Nodal Officer via email.

- Escalate to the Banking Ombudsman (under RBI).

- File a Consumer Court case for compensation.

Q6. Why do banks keep charging annual fees on unused cards?

This is a common malpractice where banks auto-renew cards unless explicitly cancelled. Customers must request written cancellation.

Q7. What are the RBI rules on credit card closure?

As per RBI guidelines, banks must close a credit card within 7 working days if a customer requests cancellation. Failure attracts penalties.

Q8. Can Axis Bank report unfair charges to CIBIL?

Yes, unpaid dues (even disputed ones) may be reported to credit bureaus. Customers should file a dispute with both Axis Bank and CIBIL.

Q9. How can customers protect themselves from Axis Bank’s unfair practices?

- Always get written confirmation when closing a credit card.

- Regularly check card statements, even for inactive cards.

- Immediately dispute any wrongful charges.

Q10. What compensation can be claimed in Consumer Court?

Customers can claim refund of unfair charges, interest, and additional compensation for mental harassment and financial stress.

Q11. Is Axis Bank known for customer harassment?

Many customers on social media have reported hidden charges, blocked cards, and poor grievance handling by Axis Bank.

Q12. What steps should Bhavesh take next?

- File a written dispute with Axis Bank.

- Escalate to RBI Ombudsman.

- Proceed with Consumer Court filing as planned.

Q13. What documents are needed to file a complaint?

- Credit card statements.

- Emails or letters from the bank.

- Proof of card being inactive/blocked.

- Complaint acknowledgment (if any).

Q14. How long does it take to resolve such cases?

Banking Ombudsman usually resolves cases within 30–60 days. Consumer Court may take longer but ensures stronger accountability.

Q15. Can annual fees be waived by Axis Bank?

Yes, customers can request a waiver, especially if the card has been inactive or wrongly charged.

Q16. What are the risks of not paying disputed charges?

The bank may report to CIBIL, but customers can dispute the entry with proper documentation.

Q17. How to close Axis Bank credit cards permanently?

Send a written closure request via email or post. Obtain written confirmation of closure.

Q18. Does Flipkart have any role in this case?

No, Flipkart only co-brands the card. All billing and disputes are handled directly by Axis Bank.

Q19. What is the Consumer Court filing process?

Customers must draft a complaint, attach evidence, and file it at the District Consumer Disputes Redressal Forum.

Q20. Can other customers join Bhavesh’s fight?

Yes, if multiple customers face similar harassment, they can file a collective consumer complaint against Axis Bank.

👉 Choice4Voice.com will continue highlighting such unethical practices to protect consumer rights.

Choice4Voice.com Is Here to Help You

If you are facing a similar issue and would like our support in highlighting your concern, we are here to assist.

Simply write a LinkedIn post and tag our official page Choice4Voice.com

Submit your complaint directly : https://choice4voice.com/submit-your-complaint/

Our team will review and feature your case on our website to ensure it gets the attention it deserves.