If you’re experiencing this problem with this brand or any other company, submit your complaint and we may feature it on Choice4Voice.com.

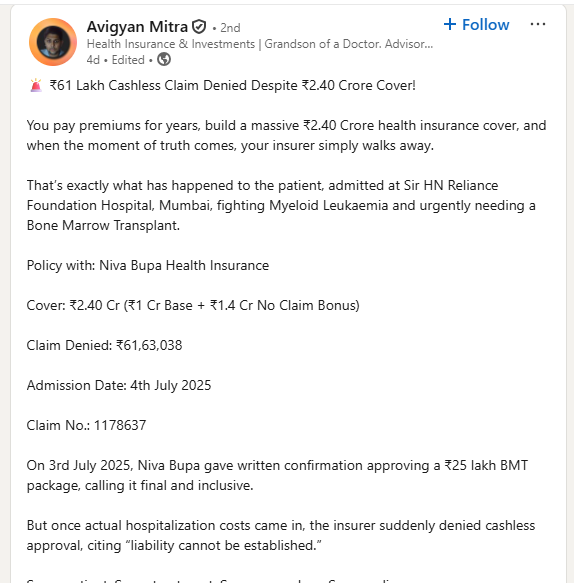

Submit your complaint →Niva Bupa Health Insurance is under scrutiny after denying a ₹61 lakh cashless claim for a Bone Marrow Transplant, despite a ₹2.40 crore cover. Complaint raised by Avigyan Mitra on LinkedIn.

Note: If this issue is resolved, the concerned brand or the complainant may contact us at support@choice4voice.com. After proper verification, we will either update this article as “Resolved” or delete it, ensuring fairness to both parties.

Complaint Summary : Niva Bupa Health Insurance Faces Serious Complaint: ₹61 Lakh Cashless Claim Denied Despite ₹2.40 Crore Coverage – Case of Avigyan Mitra

| Field | Details |

|---|---|

| Complainant Name | Avigyan Mitra |

| Company/Brand | Niva Bupa Health Insurance |

| Service/Product | Health Insurance (₹2.40 Crore Coverage) |

| Policy Holder | Mr. Jain (Patient) |

| Claim Amount Denied | ₹61,63,038 |

| Reason for Complaint | Cashless Claim Rejection Despite Prior Approval |

| Hospital Name | Sir HN Reliance Foundation Hospital, Mumbai |

| Disease/Treatment | Myeloid Leukaemia – Bone Marrow Transplant |

| Admission Date | 4th July 2025 |

| Claim No. | 1178637 |

| Status | Cashless Denied – Patient’s Family Forced to Arrange Funds |

| Source | Complaint posted by Avigyan Mitra on LinkedIn |

Case Background

Avigyan Mitra, a verified professional on LinkedIn, raised a serious concern against Niva Bupa Health Insurance regarding a claim denial that could jeopardize a patient’s life.

The patient, Mr. Jain, diagnosed with Myeloid Leukaemia, was admitted to Sir HN Reliance Foundation Hospital, Mumbai for a Bone Marrow Transplant (BMT).

Despite having a ₹2.40 crore health insurance cover (₹1 Cr Base + ₹1.4 Cr No Claim Bonus), the insurance company denied ₹61,63,038 in hospitalization bills.

Sequence of Events

- Pre-Approval Granted:

On 3rd July 2025, Niva Bupa gave written confirmation approving a ₹25 lakh package for Bone Marrow Transplant, marking it as final and inclusive. - Hospitalization & Rising Bills:

The patient was admitted on 4th July 2025. As treatment progressed, actual medical expenses exceeded the ₹25 lakh package. - Claim Denial:

Despite earlier approval, the insurer denied the cashless claim citing “liability cannot be established.” - Patient’s Family Impacted:

The family was forced to arrange ₹61 lakh in cash, during a life-threatening medical emergency.

Why This Case Matters

- Breach of Trust: A cashless denial despite prior written approval undermines faith in the insurance system.

- Life at Risk: Delays in treatment funding can cost lives, especially in critical illnesses like leukemia.

- Policyholder Rights: Consumers pay premiums for years expecting support during emergencies. Denial at such times is unethical.

- Industry Precedent: If such cases continue, it may discourage people from buying health insurance altogether.

Consumer Advocacy & Next Steps

At Choice4Voice.com, we strongly advocate for consumer rights and fair treatment. This case highlights the urgent need for:

- Regulatory Intervention: Insurance Regulatory and Development Authority of India (IRDAI) must take strict action against unfair practices.

- Transparency in Policies: Insurance companies must provide clear communication about limits, exclusions, and approvals.

- Legal Remedies: The patient’s family can approach:

- IRDAI (Insurance Ombudsman)

- Consumer Court for deficiency in services

- Civil Court for breach of contract

Questions Consumers Are Asking

Q1. Can an insurance company deny a claim after giving prior approval?

Ans: While insurers can reassess claims, denial after written approval can be challenged legally for breach of contract and deficiency of service.

Q2. What is a cashless claim in health insurance?

Ans: A cashless claim means the hospital bills are settled directly between the hospital and insurer, so the patient does not need to pay upfront.

Q3. What is the role of IRDAI in such disputes?

Ans: IRDAI regulates insurance companies in India. Policyholders can file complaints with IRDAI or the Insurance Ombudsman if they face unfair claim rejections.

Q4. What legal action can a patient’s family take?

Ans: They can approach the Consumer Forum, file a case for compensation and damages, or escalate to civil court.

Q5. What is a No Claim Bonus (NCB) in health insurance?

Ans: NCB is an additional coverage benefit given when no claim is made in previous years. In this case, it added ₹1.4 crore to the cover.

Q6. Why do insurers deny high-value claims?

Ans: Common reasons include technicalities, exclusions, or disputes on liability. However, denials after prior approval are questionable and unfair.

Q7. Can hospitals help patients fight against insurers?

Ans: Many reputed hospitals assist patients in raising disputes with insurers, but ultimate resolution depends on the insurance company and regulator.

Q8. Is cashless approval legally binding?

Ans: While insurers may review claims, documented approvals serve as strong evidence in consumer disputes.

Q9. What are the immediate steps a policyholder should take after denial?

Ans: Collect all documents, approval letters, hospital bills, and immediately file a complaint with IRDAI and the Insurance Ombudsman.

Q10. What documents strengthen a complaint against insurers?

Ans: Pre-approval letters, policy documents, hospital records, and written communication from the insurer.

Q11. Can denied claims be reimbursed later?

Ans: Yes, if proven valid, policyholders can demand reimbursement even after denial, through legal or regulatory bodies.

Q12. How can families arrange funds during emergency denial?

Ans: They may need to arrange funds temporarily, but legal remedies can ensure reimbursement later.

Q13. Are group health insurance policies safer than individual policies?

Ans: Group policies may offer quicker approvals but depend on employer agreements. Individual high-cover policies also provide strong protection if honored fairly.

Q14. Does this case qualify as deficiency of service?

Ans: Yes. Denying claims after pre-approval is a clear example of deficiency in service under Indian consumer law.

Q15. Can mental trauma and harassment be claimed as damages?

Ans: Yes, courts often award compensation for mental agony in cases of insurance harassment.

Q16. What is the typical time frame for cashless approvals?

Ans: Usually within 2–6 hours. However, high-value claims sometimes take longer.

Q17. What is the Insurance Ombudsman’s role?

Ans: The Ombudsman provides a quicker, cost-free resolution mechanism for insurance disputes.

Q18. Can public pressure influence insurers?

Ans: Yes. Social media and consumer forums often compel companies to respond quickly.

Q19. What steps can others take to avoid such issues?

Ans: Always keep written communication, understand exclusions, and demand clear approvals before treatment.

Q20. Where can affected customers file complaints?

Ans: Customers can file directly on IRDAI’s grievance portal (https://bimabharosa.irdai.gov.in) or approach the Insurance Ombudsman.

Conclusion

The case of Avigyan Mitra vs. Niva Bupa Health Insurance reflects a growing concern in the Indian insurance industry—denial of claims during critical emergencies despite prior approvals.

This issue goes beyond one patient; it is a wake-up call for policyholders, regulators, and the entire industry. Families buy health insurance for security, not betrayal.

At Choice4Voice.com, we stand committed to amplifying such genuine consumer complaints to ensure accountability, transparency, and justice.

Choice4Voice.com Is Here to Help You

If you are facing a similar issue and would like our support in highlighting your concern, we are here to assist.

Simply write a LinkedIn post and tag our official page Choice4Voice.com

Submit your complaint directly : https://choice4voice.com/submit-your-complaint/

Our team will review and feature your case on our website to ensure it gets the attention it deserves.